A guide in the art market

Today the art market is a complex and hard-to-interpret world, characterized by a series of specific problems, such as the danger of forgeries or misattributed artworks.

For the inexperienced collector, acquiring new works and managing his collection in total safety becomes a major problem.

For this reason, it is important to know and rely on specific professional figures able to avoid the main risks, including the Art Advisors.

In response to the increasing complexity of the art market, new professional figures were born, able to cope with the need for protection and transparency by the various players in the sector.

Among these the Art Advisor, professional with the task of assisting the collector in the creation, management and enhancement of its collection, acting like a real “guide”.

In fact, the Art Advisor supports both young collectors who want to start acquiring works, both the expert collectors intending to increase their collection or sell their works safely.

Five main tasks are recognized to the Art Advisor:

- It guarantees historical-artistic skills and in-depth knowledge of the market, keeping up to date on financial trends

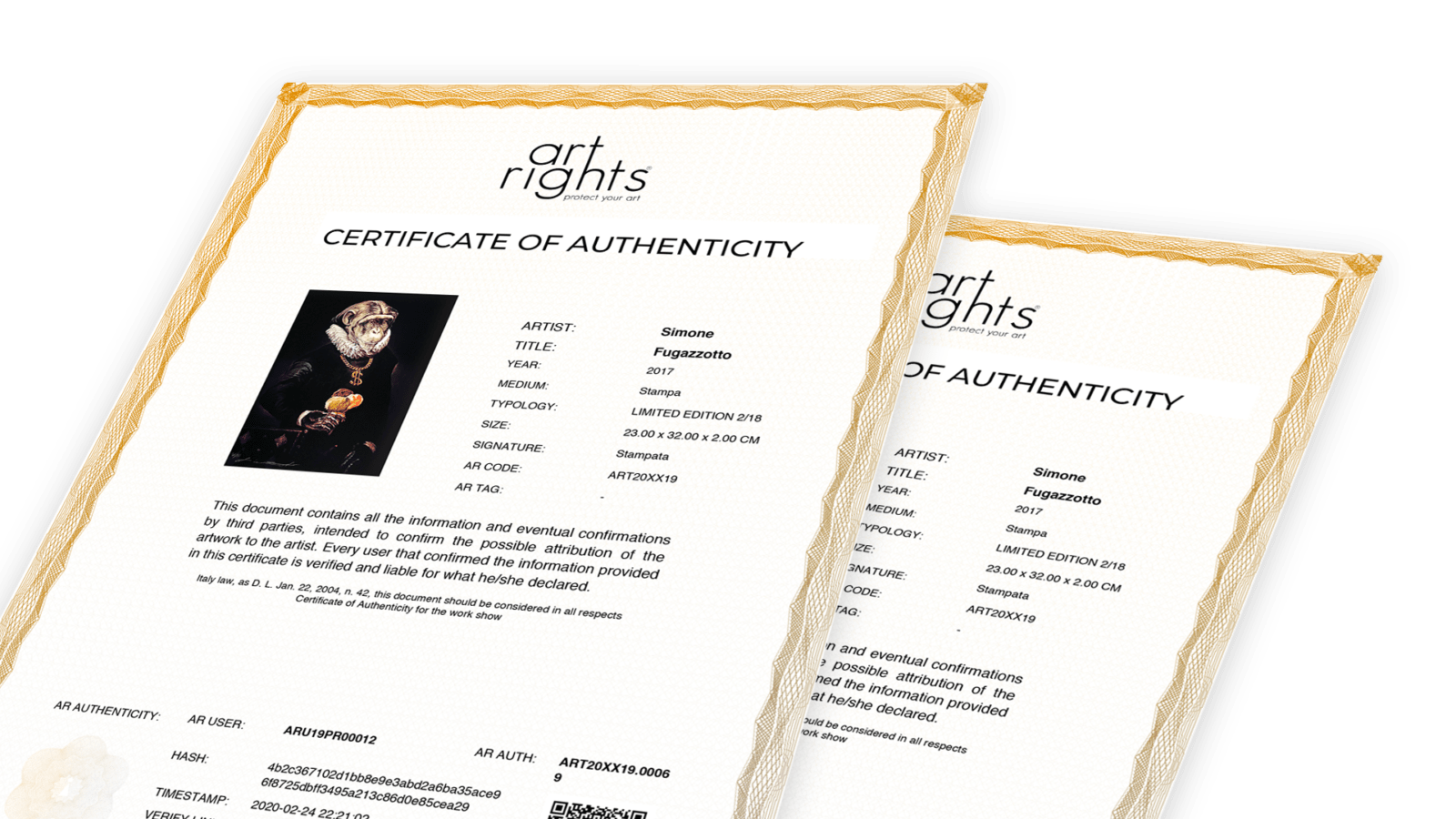

- He verifies provenance and authenticity of an artwork, carrying out the due diligence

- He is able to undertake economical assessments on artworks

- He optimizes financially the management of artworks, with attention to the methods of valorisation, circulation, conservation, transport or insurance.

- Supports the collector when the latter is undertaking di new investments

This figure can therefore work as an independent consultant or for law firms and large investment banks. Indeed, more and more often, large banks open Art Advisory departments, with the aim of retaining their customers, increasingly oriented towards investments in passion assets such as art rather than in stocks and bonds.